Mortgage Rates Plummet, Changing Everything – For Now | Living In Phoenix Arizona

MORTGAGE RATES PLUMMET, CHANGING EVERYTHING – FOR NOW

LIVING IN PHOENIX, ARIZONA

Mortgage Rates Plummet, Changing Everything – For Now

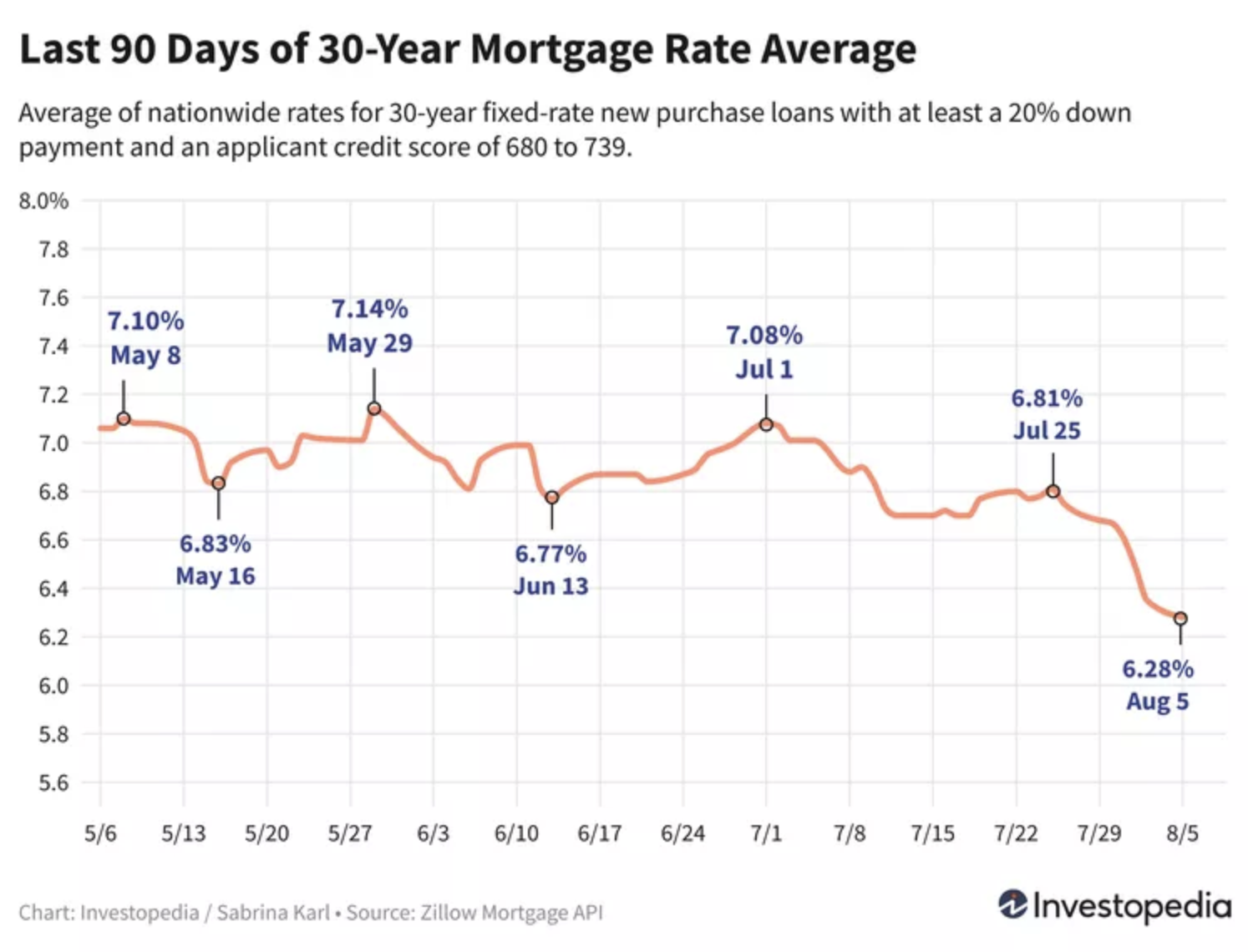

Mortgage Rates Quickly Dropped Between 40 And 80 Basis Points In Some Loan Scenarios, But The Question Is Whether This Will Stick

Prospective borrowers with strong credit are locking in mortgages this week at the lowest rates in more than a year, loan officers and lending executives told HousingWire on Friday.

A sample of more than a dozen industry professionals said they were quoting most borrowers in the high 5% to low 6% range on government loans and in the mid-6% range for conventional mortgages. Quotes vary based on credit scores, points and other factors.

This generally matches up with data from Mortgage News Daily, which looks at marketed rates for strong credit profiles. On Friday, it recorded conventional 30-year mortgage rates of 6.40% and 15-year conventional rates of 5.89%. Fixed rates through the Federal Housing Administration (FHA) were at 6.10% and those through the U.S. Department of Veterans Affairs averaged 6.12%. Some rates were down nearly 50 basis points in a single week.

In just the past day, loan officers should have seen their pricing improve between 25 and 40 basis points on government loans, and by 20 to 60 basis points on conventional scenarios, said Rick Roque, executive vice president of retail at Sierra Pacific Mortgage. The rate declines “means better pricing to consumers, incentivizing them to take advantage of approximately half a percentage point in rate improvement in the market,” he said.

Here’s How LOs Are Handling The Sudden Drop In Rates.

Indeed, one West Coast LO told HousingWire that he quoted a borrower a 5.75% rate on a 30-year FHA loan for a $500,000 Southern California home purchase. The borrower had a 700 FICO score and is putting down 3.5%.

“I don’t think we’ll see a big refi move until September,” the LO said, adding that it should be a “decent fall and winter for refis.”

Several LOs and mortgage executives told HousingWire they’ve seen an uptick this week in refi interest and in purchase locks, especially following the jobs report. But few are popping the champagne just yet.

“Vibes are cautiously optimistic,” said Jay Promisco, president of Sierra Pacific Mortgage. “A lot of floaters are waiting for more improvement. Rates are firmly in the 6s for most scenarios, and not a lot of reasons right now based on the economic data for rates to go back up. It might be a fun end-of-summer rally. Doesn’t help the inventory issue, but lower rates for borrowers is always good.”

Ravi Patel, a branch manager for UMortgage in Kentucky, said he’s working with borrowers to take advantage of the here and now.

“We’re in a unique window of opportunity where these lower rates haven’t had a strong foothold in the market yet. … It hasn’t been consistent yet,” Patel said. “For buyers actively looking, there’s not as much competition yet. But as these rates are consistently in the low to mid 6s and the high 5% range, all these buyers on the sidelines are going to get off the sidelines and look at houses. That will create more demand, and with supply still being an issue, we’ll be seeing multiple-offer situations and appraisal gaps.”

For refi clients, he’s preaching patience. Patel is in conversation with existing clients who can save between 50 to 75 basis points. But it depends on their circumstance — some might benefit from waiting another month or two, when rates potentially could drop even more significantly.

“With refinances, time is more on our side,” he said. “I’m not in a huge rush to lock because I think this is the start of the trend of rates continuously moving lower. Is it right for the client?” – more at housingwire.com

Thinking about investing in Phoenix real estate? Have a property to sell in Arizona? Tell us what you’re searching for. Connect with us to buy, sell, or lease multifamily, residential and commercial real estate in Phoenix, and across Arizona. Let’s work together.

Natan Jacobs, Vestis Group

Call: 602-281-6202

Email: Info@Vestis-Group.com